|

In an earlier post, I talked about using expense tracking to see where you’re at financially. But income and expenses are only part of the picture. Another aspect is what you own (assets) versus what you owe (liabilities). Please note that I’m using loose definitions here, and I’m only talking about personal assets. Accountants use more complex definitions, and business assets, such as income-producing rental property, are not included. Assets More specifically, assets are things you own that you could sell—for example, furnishings in your home, a car, artwork, musical instruments, your late grandma’s chess set, and so on. Your home itself is an asset if you’re buying rather than renting. Shares of mutual funds or other personal investments count as assets. Cash you have on hand or the cash value of bank accounts are also assets. Your dwelling is not an asset if you rent it. Neither is a vehicle you lease. Rental and lease payments go under expenses, although car leasing is a special case. Liabilities The mortgage you’re paying on your residence is a liability, and so is car loan debt. In these cases, the debt you owe is “secured” by the asset; if you fail to make the payments as you agreed, the assets could be subject to foreclosure or repossession. You might also have other liabilities, such as credit card debt. Credit card debt is primarily “unsecured” debt—for example, you used credit cards to purchase meals out, buy gasoline, pay for a vacation, and so on. Expenditures like these are basically personal expenses, and you’re paying them by taking out a loan from the credit card company at a huge interest rate (average is 16.15%). You promise to pay the company the original amount plus interest. There’s no asset that can be “taken back.” Student loan debt is also unsecured debt. It’s not like the Fed can take back your degree! Plus there’s no guarantee that you’ll even earn a degree. Either way, you have promised to pay. Net Worth The difference between your assets and your liabilities is termed your “net worth.” When people talk about “wealth,” they’re referring to a high net worth. How much income someone makes doesn’t figure in. Here are two hypothetical households with different net worth:

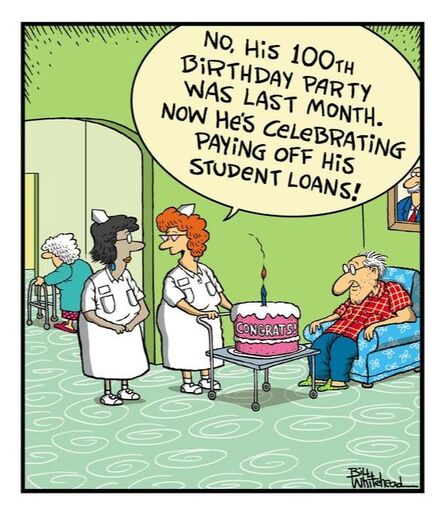

Because household A has no liabilities, A’s net worth is equal to A’s assets. Household B has sizeable liabilities, and so B’s net worth is lower, even though B has more in assets. Put another way, household A is “wealthier.” It’s possible to have liabilities that exceed your assets. Being “upside down” on a mortgage is one example. If you owe more than you own overall, you have a negative net worth. According to the financial-advice company Motley Fool, 16.6 million American households, or 14%, had a negative net worth in the spring of 2017. (I don’t imagine it’s any better now.) What do you think is the biggest contributor to this negative net worth? It’s not mortgage debt, credit card debt, or payday loans, although these do contribute. The largest liability burden in households with negative net worth is student loan debt. This isn’t a problem only for younger generations; an article from Business Insider in 2019 reported that more than 3 million Americans over age 60 collectively owed more than $86 billion in unpaid student loans. That kind of liability can kick the stuffing out of net worth. For more details:

Maurie Backman, “16.6 Million U.S. Households Have a Negative Net Worth—Here’s the Surprising Reason Why.” Motley Fool, May 14, 2017. (Click here.) Kelly McLaughlin, “3 million senior citizens in the US are still paying off their student loans.” Business Insider, May 3, 2019. (Click here.)

1 Comment

The Sierra Nevada, the range of “snow-capped mountains,” rises along the western edge of the Great Basin. The dividing line that was drawn between Nevada and California begins near the Cascade Range in the north and then follows the Sierra south, taking a bend at Lake Tahoe. The Sierra juts up into the humid atmosphere moving east from the ocean and drags the moisture out of it. Snowfall in the Sierra can be massive, and avalanches and slides come without warning.

Gambling is legal in Stateline, and it’s a lot less hardcore than in Reno—at least it was at that time. One casino had a roulette table that took ten-cent chips. I was in roulette heaven.

The old VW Rabbit, which was also called the Golf, was a reliable small car with 74 horsepower—about half that of a 2016 Ford Focus. With the engine in the front and front-wheel drive, plus a 5-speed manual stick shift, it was useful for mountain roads—you could drop it into a lower gear and stay there to climb summits. Ours was beige, similar to the one in the photo shown here. We set off on I-80 to Sacramento, but soon began receiving warnings that it was snowing in the Sierra. By Sacramento, reports were saying that US Route 50 was closed over Echo Summit. We had to make a choice. We decided to continue on US 50 just in case we could get through. Radio reports said the road was closed. Those Variable Message Signs spanning the highway warned that the road was closed and vehicles needed to turn back. But we saw no barricades. My thinking was, if the road was truly closed, eventually we would get to a barricade and be forced to turn back. Yes, we’d probably have to go all the way back, at least to Placerville, and then go north to pick up I-80.

I was reminded of the film “On the Beach,” a classic post-apocalyptic film from 1959 centering on the crew of a nuclear submarine, USS Sawfish. In this film, nuclear war had broken out, and everyone who hadn’t been incinerated was dying from radioactive fallout as it spread throughout the Earth. In one scene, Sawfish makes its way to San Francisco and surfaces. The camera shows streets completely and eerily empty. That’s how it felt on US 50; a world devoid of people.

I asked the officer if it was possible to go over the summit to South Lake Tahoe. He said that the highway plow, a big front loader with a snowplow attachment, was soon to start up and over the pass, and that’s what the cars were waiting for—to follow the plow. He asked if we had chains. Of course we had chains! In California, it’s a good idea to carry chains in the trunk on general principles, and they are required in cases like this. Ours were the cable-chain variety—not the big heavy ones like you might see on “Ice Road Truckers.” But they were chains. The patrolman said to put them on, because the convoy would be leaving soon. We then experienced the thrill of putting the chains on the front tires in semi-darkness in snow. When we bought the chains, I had taken the time to do a dry run, so I knew how to do this, in theory. It’s best to know how, because the highway patrol will not do this for you. Naturally, a dry run isn’t the same as being wet out in the snow, having freezing fingers, and not being able to get that inside clip to attach. Perseverance furthers. We got in line and made our way over the pass, at a crawl, in blizzard conditions. The yellow lights flashing on the plow ahead in the blowing snow were a comfort, although it was a false comfort; the danger was above us, not ahead of us. But we managed to slip by. On the other side, off came the chains, and we proceeded to our destination. We had made it in one piece and were feeling pleased with ourselves, as though our decision to keep going had been confirmed as the correct one, and not just a lucky break.

I think we decided to take I-80 to get back home. That was probably a good thing. Two weeks later an avalanche and landslide closed US 50. This time there were barricades, and the road didn’t open for weeks.

|

Categories

All

Archives

January 2024

|

RSS Feed

RSS Feed